With so many Forex brokers now touting the virtues of a No Dealing Desk environment, or agency model as it’s coming to be known, it’s high time we looked into just what these developments in the industry mean for you the trader. Is this just a fancy PR campaign on behalf of the brokers, or is a higher level of transparency finally finding its way into the world of retail Forex?

At the moment there seems to be something of a schism, with certain brokers happy enough to carry on as Market Makers (Oanda, GFT) and others keen on distancing themselves from the market maker model and coming out as strong proponents of the Agency Model (FXCM, FxPro). Of course the shakeup in the industry can only benefit the traders, as it means more competition, not only between adherents of the same model, but also competition between models as every broker vies to be acknowledged as the biggest, most liquid and most transparent of them all.

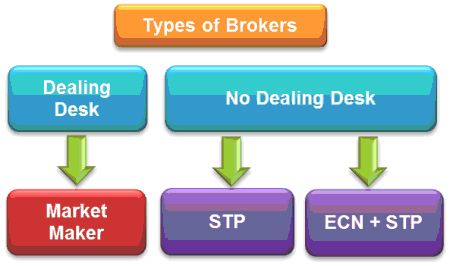

Firstly it’s important that we define our terms as the various acronyms that get tossed around in the industry are a major source of confusion for many people.

Market Maker (MM)

In the Market Maker model, (often abbreviated to MM) brokers provide liquidity and act as counter-parties to the positions of their clients. So when trading with a Market Maker, if you buy a certain volume of a given asset, they will then go onto their liquidity market and open a mirror trade, selling the asset you chose to buy and keeping the difference between your Buy order’s price and their Sell order’s price as a premium. This is where the conflict arises, because in the Market Maker model a winning trade for the client is a losing trade for the broker, and vice versa. In addition to this, when trading with a Market Maker another concern that many traders have is that the broker has access to traders’ take profit and stop loss levels, as well as their profit and loss ratios, which gives them a significant advantage should they choose to use that information in an unscrupulous way. That is not to say that all Market Makers are unscrupulous, the majority of FX brokers in today’s industry are indeed Market Makers and they can’t all be crooked. Another disadvantage of trading with an MM is that the need to pass orders through a dealing desk before executing them and then open two trades rather than one, thus making MM trading slower than STP or ECN, increasing the likelihood of re-quotes, slippage and cancelled orders.

No Dealing Desk (NDD)

No Dealing Desk (or NDD for short), as the name implies, indicates that the broker in question does not operate a dealing desk. Dealing desks are operated by brokers who act as Market Makers (described below), which basically means that there is some human intervention between a client’s trade and the market they are trying to enter. Dealers filter incoming orders before executing them, they can turn an order down at a given price and send a re-quote to the trader, alternatively they can actively delay an order if the prevailing market conditions are unfavourable to the broker in question. No Dealing Desk means that a trader’s orders are automatically routed to liquidity providers with no intervention from a dealing desk. Essentially what this is supposed to mean is that if you trade with an NDD broker then there is no conflict of interests between you and them. NDD brokers provide their traders with access to the interbank market, they work with liquidity providers to secure the best possible bid and ask prices for their clients, whose orders are put straight through without being managed in any way. In a No Dealing Desk environment brokers profit from the volume traded by their clients, not through their losses; this is because they either charge a set commission (as in the case of ECN), or they impose a small mark-up on the spread offered by their liquidity providers (as in the case of STP). NDD brokers are all either STP, or STP + ECN (more on this further on). The absence of a dealing desk means that STP and ECN brokers can provide faster trade execution times with less latency than brokers that act as Market Makers.

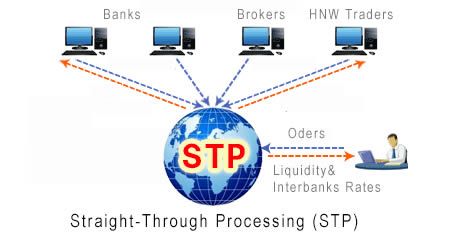

STP (Straight -through Processing)

Straight-through Processing means that a broker takes client orders and puts them anonymously straight through to liquidity providers, without any human intervention between the trader and the liquidity provider in question. This necessarily implies the absence of a dealing desk, however even though STP and NDD are pretty-much synonymous, traders should be aware that brokers advertising themselves as STP may still operate a dealing desk on other tradable instruments or platforms that they offer. Indeed some even run a hybrid between STP and MM whereby the market for smaller traders is made by the broker (for smaller traders read trades under 0.1 lots), and larger orders (over 0.1 lots) are routed to liquidity providers.

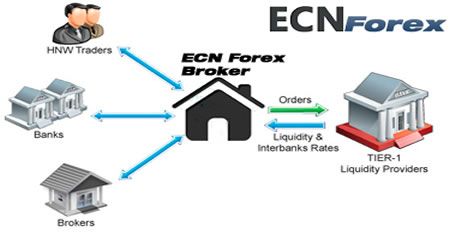

Electronic Communication Network (ECN)

This is where people tend to get really confused. Electronic Communication Network necessarily implies Straight-through Processing, but not all STP transactions are ECN. Allow us to explain: In ECN trading brokers enable their clients to trade on a marketplace where participants (whether they are Market Makers, banks or individual traders) are effectively competing against each other to get bids and offers into the network. ECN allows the best possible bid and ask prices to be secured in real time over a network of liquidity providers. In other words a trader may be securing respective bid and an ask prices from two different liquidity providers, thus ensuring the best possible price at all times. In ECN trading brokers do not mark-up a spread, but rather charge a commission for trading on the network. Another advantage of true ECN networks is that they enable traders to interact directly with the orders of other individual traders. As in the case of STP orders are anonymous and a greater pool of liquidity in real time translates directly to faster trade-execution times.

Recap

So, to recap: all true STP and ECN brokers are NDD, but not all STP brokers are ECN, also all ECN brokers are STP, but some STP brokers are a hybrid of STP and MM. Clear as mud?

Which is Best for Traders?

There are a number of things to consider when asking this question. Firstly, as already stated STP and ECN can’t help but be faster than trading with a dealing desk. This is because the dealing desk’s intervention and need for a second trade to be placed in order to hedge against the client’s inevitably slows things down.

In addition to trade execution it’s vital to consider that with the agency model the particulars of a trader’s activity remain completely hidden from the markets. When dealing with a Market Maker there are many sneaky techniques that brokers can employ to ensure that they maintain the upper hand. Trader profiling is a perfect example of this: having access to the histories of each and every one of their traders enables Market Makers to separate and ring-fence traders into different groups. Statistically poorer traders can be automatically dealt with en masse simply by trading against them. More successful traders can be corralled into a different group in which their trades are manually slowed down, and affected by re-quotes and slippage until the broker’s statistical advantage remerges.

It all boils down, quite predictably, to where the money is coming from. Market Makers make money both on the spreads they impose and on betting against their traders. When a trader is successful this eats into their profits. While most Market-Making Forex brokers are professional and above board, some may choose to do whatever they can in their power to “help” successful traders return their winnings to the broker’s coffers.

STP brokers are better in that they offer their clients a degree of transparency, and make their own money through the mark-ups they impose on spreads. STP brokers want their traders to continue trading, more successful trades begets more activity, and more activity means more profit from the spreads. It is important to bear in mind though, as already mentioned, that many brokers are hybrids between STP and MM. Their smaller traders (anything under 0.1 lots), who do not meet volume requirements imposed by liquidity providers, are not put straight through, but rather the broker becomes the market maker for these trades and all the loopholes discussed in the previous paragraph come back into play. The larger traders (over 0.1 lots) are dealt with on a NDD basis and routed through to liquidity providers. Be aware of whether your trades are being put straight through or whether the market is being made for you.

ECN brokers are indeed the most transparent of the three models. They offer the best bid and ask prices, they allow traders to enter a true market rather than creating one themselves, they also allow their traders to participate in the markets in a way that Market Makers or indeed STP alone can’t match. However, and it’s our duty to point this out rather than just acting as fan boys for one specific type of trading, if a broker is tricky enough, there is no system in existence that they can’t bend towards them a touch. Even ECN is vulnerable to this. The absence of a dealing desk should not be conflated with transparency until the evidence speaks for this interpretation. There are a lot of things that can be done to bend the odds in a broker’s favour without employing a dealing desk. Automated risk management software is so advanced nowadays that even without a dealing desk it can be employed so that brokers can compete with their clients as far as pricing goes. So, when there is market inefficiency they can perform arbitrage or even keep certain trades in-house without ever revealing this to the trader. None of these techniques require a dealing desk.

Last Word

The fact that NDD, STP, ECN and the agency model are being bandied about so much lately speaks to the fact that brokers are recognising the call for further transparency on behalf of their clients. This is a good thing as far as we are concerned. The industry has come along in leaps and bounds from the Wild West days a couple of decades back. And yes, there will always be some degree of wiggle room for the advantage to be snatched back by the broker, but this is becoming harder and harder as traders become more and more educated, more and more demanding, and there is so much competition for their risk capital. We applaud the move many brokers have made from MM to STP and ECN, without forgetting that there are many happy to offer their clients a solid service as Market Makers. The most important thing, as always, to be educated, to know what you’re getting into, and to be able to discern when you’re not being given a fair deal. Thanks for reading.