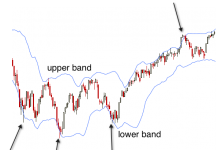

The other type of oscillators are known as banded oscillators. These oscillators move between a high and low point without a centre mark and again indicate overbought and oversold levels at either end. Stochastic banded oscillators will typically have a mark above which traders can ascertain overbought securities and below which indicate overbought securities. They are also often customisable so traders can set their own trigger points. Relative Strength Index (RSI) is a particularly popular banded oscillator which indicates overbought assets above the 70 mark and oversold assets below the 30 mark.

Generally speaking oscillators are used by traders to generate educated buy and sell trading signals. They are used extensively in the trading of binary options as binary traders can capitalise on market movements very swiftly and place a series of rapidfire trades capitalising on reversals. It should be borne in mind that oscillators are normally used alongside other types of technical indicators. This is because are only useful for giving one side of the picture, namely momentum. They can be paired up with other indicators such as those that analyse volume or support and resistance to get a clearer view of the market. Two particularly well paired indicators are RSI and MACD.